Assessor

I want to welcome you to the Sabine Parish Assessor's Website.

Sincerely,

Chris Tidwell

Sabine Parish Assessor

Assessor Responsibilities

The Sabine Parish Assessor is responsible for discovery, listing, and valuing all property in Sabine Parish for ad valorem tax purposes. This property includes all Real Estate, all Business Movable Property (Personal Property), and all Oil & Gas Property and Equipment. The Assessor is responsible to the citizens of Sabine Parish for ensuring all property is assessed in a fair and equitable manner. At the same time, the Assessor is responsible for ensuring that assessments are calculated according to the Constitution of the State of Louisiana and the Revised Statutes that are passed by the Legislature. In Louisiana, “Ad Valorem”, by value, is the method to calculate taxes. The Assessor does not establish the “taxes”. Taxes are approved by the voters in the form of millage propositions on the ballot.

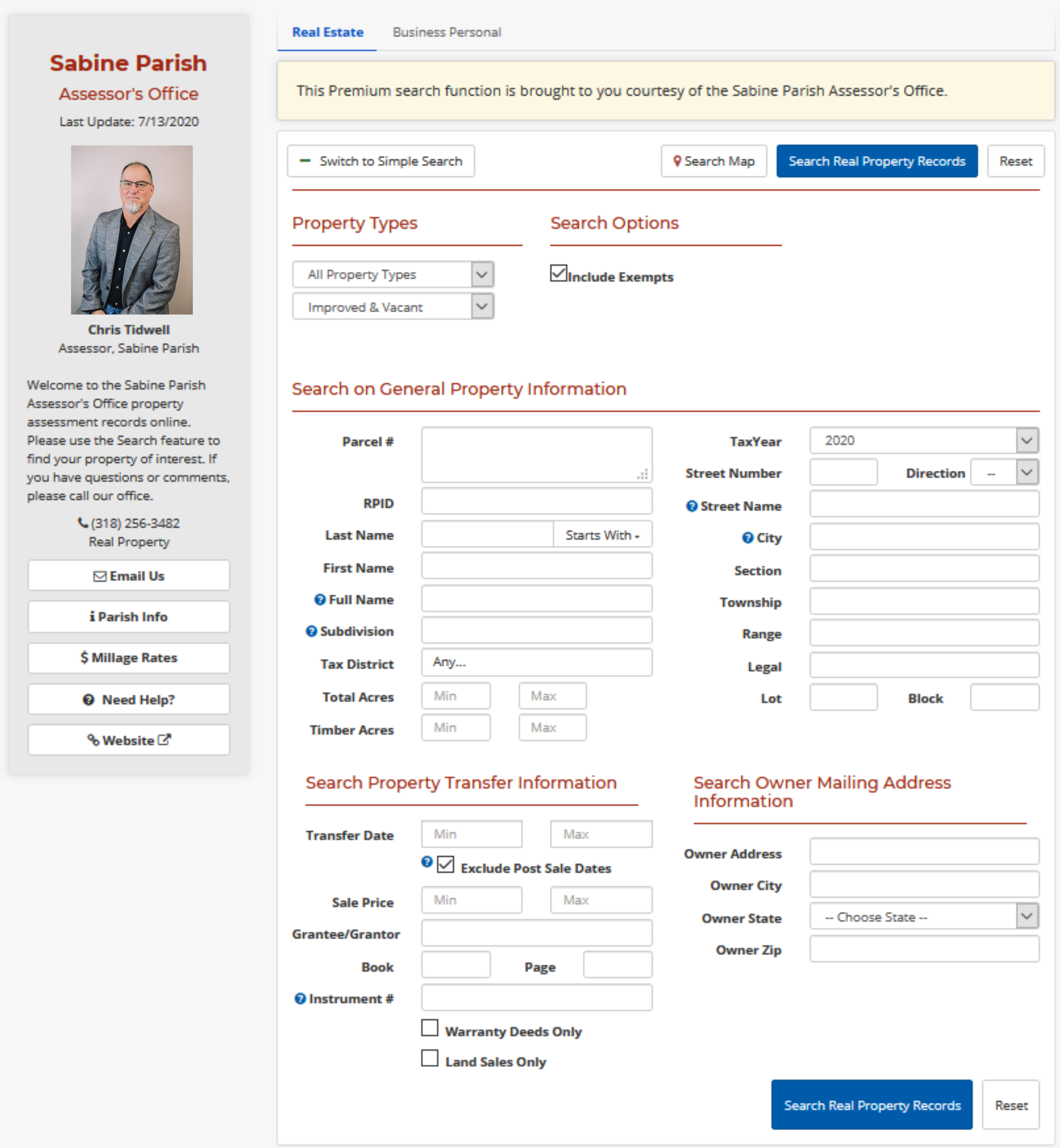

Real Property Search

Sabine Parish's real estate records are available online and free to the public. Search records using a variety of different search criteria such as name or address.

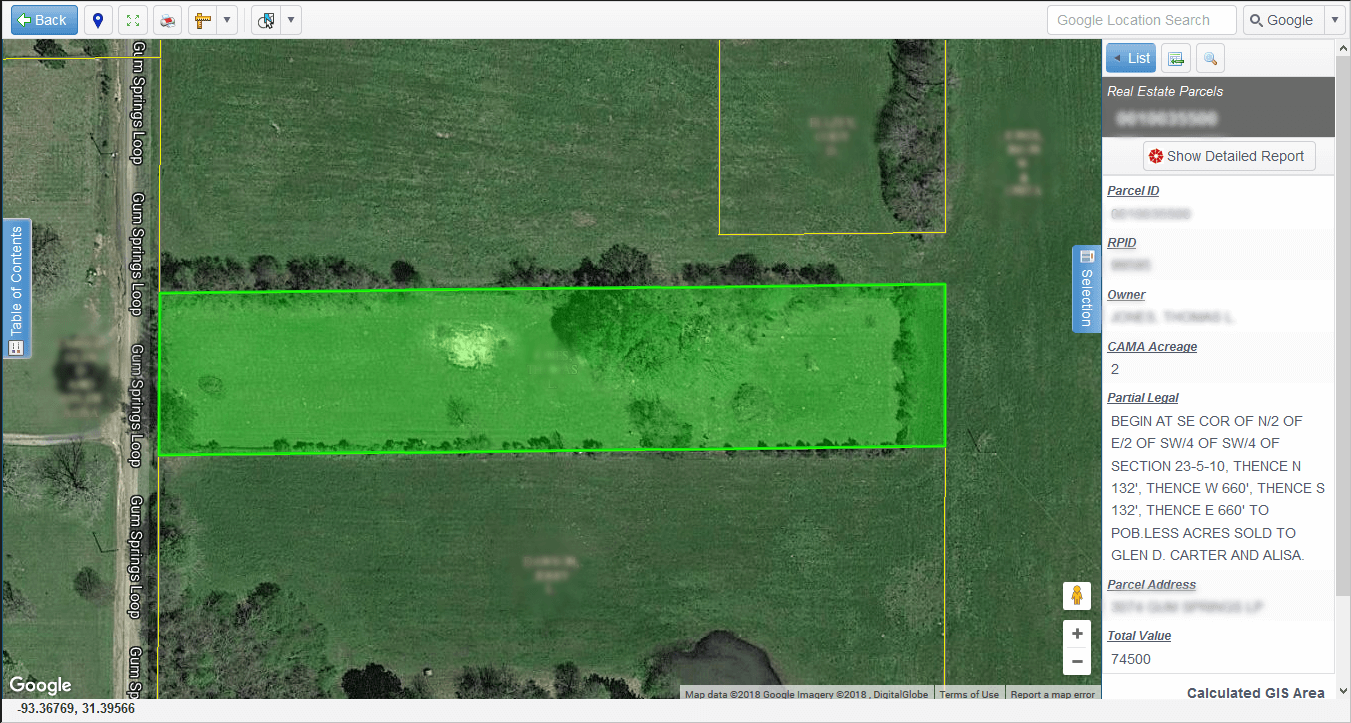

Interactive Mapping

Use the power of the interactive mapping functionality by searching, viewing, and selecting different properties of interest directly on the map.

Forms / Links

Find common forms for assessing and appeals.

View links to local and state agencies.

Upcoming Dates

April 1

Deadline for filing self-reporting forms for business personal property.

Important Dates

- April 1 - Deadline for filing self-reporting forms for business personal property.

- July 15 - Value letter sent out. This is a required notice to let you know about changes to your assessment. This is a good time to call or come into the office to discuss your assessment.

- July 24 - Notice to Louisiana Tax Commission(LTC) of Public Exposure dates/Open Book period.

- August 14 - Books are open for review of the 2025 tax roll.

- August 29 - Open book period will close for the 2025 tax roll.

- September 10 - Deadline to appeal to the Board of Review(BOR).

- September 17 - Board of Review Meets.

- October 18 - Deadline to appeal the BOR’s decision to the LTC

- November - Tax roll filed with the Louisiana Tax Commission.

- December 31 -Property Taxes are due and payable to the Sheriff’s Office by this date or will become delinquent thereafter.

PLEASE NOTE: YOU MUST SUBMIT ALL INFORMATION CONCERNING THE VALUE OF YOUR PROPERTY TO THE ASSESSSOR BEFORE THE DEADLINE FOR FILING AN APPEAL WITH THE BOARD OF REVIEW. THE FAILURE TO SUBMIT SUCH INFORMATION MAY PREVENT YOU FROM RELYING ON THAT INFORMATION SHOULD YOU PROTEST YOUR VALUE.

- OR

- 1. Delivery of BOR decision

- 2. Written transmission of the BOR notice of determination.